The different Incoterms

As part of the development of the international order form for your articles or products to be manufactured by your forwader, it is necessary to see the type of INCOTERM retained for this sales contract.

The types of incoterms used define the share of responsibility of the buyer and the seller during the freight of the goods.

- The duties of the buyer and the seller

- Who takes care of the insurance, licenses, authorizations and all other formalities

- Who organizes the transport how far and who is responsible

- The point where cost and risk pass from the seller to the buyer.

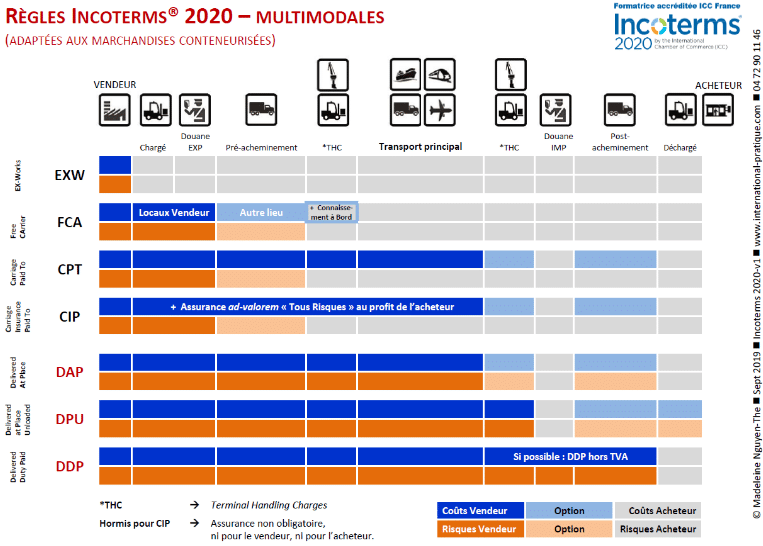

The Incoterms 2020 are organized into two main categories: Maritime transport and other methods of transporting goods (air or other).

The ICC has launched the Incoterms 2020, which are effective from January 1, 2020. The Incoterms 2020 do not contain any major changes. The most important difference in the types of Incoterm 2020 used is the appearance of a new Incoterm DPU (Delivered at Place of Unloaded).

It replaces the Incoterms DAT (Delivered at Terminal). The destination location can be any location and does not have to be a terminal.

EXW – ExWorks (2010 and 2020)

For these types of incoterms used, the seller has duly delivered the goods as soon as they have been made available to the buyer on his premises, without completing customs export formalities and without loading on a any kidnapping vehicle.

FCA – Free Carrier (2010 and 2020)

The seller has duly delivered the goods as soon as the latter, cleared for export, has been made available to the carrier named by the buyer at the agreed place.

CPT – Carriage Paid To (2010 and 2020)

The seller has duly delivered when he has made the goods available to the carrier appointed by him; however, the seller must also pay the transport costs for the delivery of the goods to the agreed destination. The term CPT requires the seller to clear the goods for export.

CIP – Carriage and Insurance Paid (2010 and 2020)

The seller has duly delivered when he has made the goods available to the carrier appointed by him; however, the seller must also pay the transport costs for the delivery of the goods to the agreed destination. However, when the term CIP is chosen, the seller must also provide insurance during transport. Accordingly, the seller concludes an insurance contract and pays the insurance premium. The buyer should note that according to the term CIP the seller is only obliged to take out insurance for a minimum cover. The CIP term requires the seller to clear the goods for export.

DPU – Delivered at destination unloaded (2020)

The seller delivers until the unloading of the means of transport arriving, this type of incoterm used bears the risk up to the place of destination. This term can be used for any mode of transport.

DAP – Delivered to place of destination (2010 and 2020)

The seller pays for transport to the place indicated, with the exception of the costs related to customs clearance on importation.

DDP – Delivered Duty Paid (2010 and 2020)

The seller delivers the goods to the buyer, cleared for import and not unloaded. The seller must bear all the costs and risks of bringing the goods there.

FAS – Free Alongside Ship (2010 and 2020)

The seller has duly delivered once the goods have been placed alongside the ship, at the agreed port of embarkation. The term FAS imposes on the seller the obligation to clear the goods for export.

FOB – Free on Board (2010 and 2020)

The seller has duly delivered when the goods have passed the ship’s rail at the agreed port of shipment. The FOB term requires the seller to clear the goods for export. It is to be used exclusively for transport by sea or inland waterways.

CFR – Cost and Freight (2010 and 2020)

The seller has duly delivered when the goods have passed the ship’s rail at the port of embarkation. The seller must pay the costs and freight necessary to bring the goods to the named port of destination. Additional costs resulting from events occurring after delivery are transferred from the seller to the buyer. These types of incoterms used exclusively for transport by sea and inland waterways.

CIF – Cost, Insurance, Freight (2010 and 2020)

The seller has duly delivered when the goods have passed the ship’s rail at the port of embarkation. He must also pay the costs and freight necessary to bring the goods to the agreed port of destination.

It must also provide marine insurance. As a result, the seller concludes an insurance contract and pays the insurance premium. The buyer should note that according to the CIF Incoterms, the seller is only obliged to take out insurance for a minimum cover.

DAF – Delivered At Frontier (2000)

The seller has duly delivered when the goods have been made available to the buyer at the agreed place and at the agreed border location

The word “border” can be used for any border including that of the country of export. The term DAF can be used regardless of the mode of transport when the goods are to be delivered at a land border.

DES – Delivered Ex Ship (2000)

The seller has duly delivered when the goods not cleared for import have been placed at the disposal of the buyer on board the ship at the named port of destination.

DEQ – Delivered Ex Quay (2000)

The seller has duly delivered when the goods, not cleared through customs, have been made available to the buyer at the named port of destination.

The term DEQ requires the buyer to clear the goods for import and pay the costs of customs formalities as well as any duties, taxes This term can only be used when the goods are to be delivered after transport by sea, inland waterways or multimodal transport and unloaded from the ship on the quay at the named port of destination.

DDU – Delivered Duty Unpaid (2000)

The seller delivers the goods to the buyer not cleared for import and not unloaded. The seller must bear the costs and risks of transporting the goods there.

You can obtain more information as well as a complete description of each of the Incoterms often used by visiting the customs website (french)